The Smarter Way to Scale: How Banks Can Consolidate Marketing for More Growth

Traditional bank marketing strategies, often fragmented across numerous disconnected tools and platforms, lead to inefficiencies, inconsistent branding, and wasted resources. Multi-location financial institutions face unique challenges: managing local visibility, maintaining consistent brand messaging, and effectively responding to customers across various locations and platforms.

The Hidden Costs of Fragmentation

Banks relying on disparate marketing tools often become bogged down in inefficiencies. Each additional platform adds complexity, complicating accurate listings, consistent messaging, and timely customer interactions. Fragmented strategies result in outdated information, neglected customer reviews, and lost opportunities, significantly impacting customer experience and trust.

According to our most recent Consumer Behavior Index, 42% of consumers prefer generic search terms over branded ones, highlighting the crucial need for consistent, accurate local listings and a robust online presence.

Inconsistent branding can also confuse potential customers, diminishing trust and brand equity. When local branches appear disconnected or misaligned with corporate messaging, it creates uncertainty, ultimately pushing customers toward competitors who present clearer, more unified experiences.

Consolidation as a Strategic Advantage

Banks can simplify their marketing processes, amplify their local impact, and achieve strategic growth by unifying social, search, and reputation management into a cohesive platform.

Using a consolidated platform, banks can:

- Ensure compliant, accurate brand messaging across all local markets.

- Rapidly respond to customer reviews, a critical action considering 65% of consumers state responsiveness influences their choice of business.

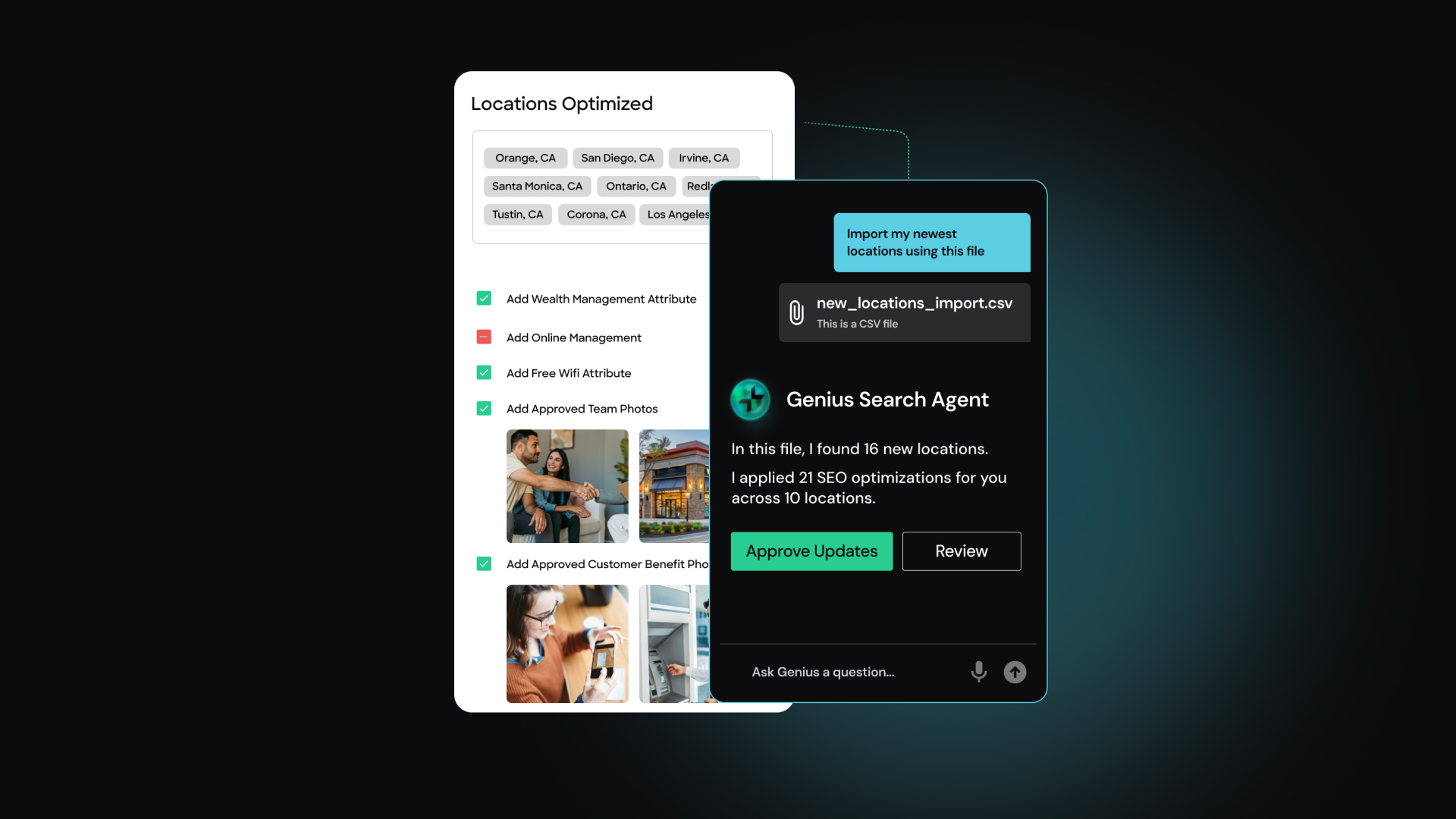

- Leverage real-time data and AI-driven insights to anticipate customer needs and optimize marketing decisions.

- Utilize AI-driven tools to streamline tasks, freeing staff to focus on strategic, high-value activities instead of manual, repetitive tasks.

Optimized online reputation and local search are powerful drivers of growth in financial institutions, directly influencing customer decision-making and conversions.

Further reading: More Borrowers, Less Effort

Real-World Success Stories: Financial Institutions Thriving with SOCi

Several financial institutions have experienced significant benefits by consolidating their marketing strategies through the SOCi Platform:

- Tower Loan utilized SOCi Genius AI to scale trust and drive traffic, enhancing local discoverability and customer engagement. Their success exemplifies how automation and AI-powered processes boost operational efficiency and growth. Read more.

- Liberty Tax embarked on a digital revolution using SOCi, transforming local marketing from a manual burden into a strategic advantage, substantially increasing their digital visibility and consumer trust. Explore their story.

- Mutual of Omaha Mortgage significantly increased their online leads by streamlining reputation management and local search strategies with the SOCi Platform. Their enhanced visibility and consistent engagement resulted in a substantial boost in digital leads and revenue. Discover their approach.

Realize Your Growth Potential

Consolidating your bank’s marketing strategy into a unified platform is more than efficient—it’s transformative. With integrated social, search, and reputation management capabilities, banks can proactively shape their local presence, enhance consumer trust, and unlock sustained growth.

The modern banking landscape demands speed, accuracy, and authenticity. A consolidated marketing platform empowers your institution to navigate today’s fragmented consumer journeys effectively and strategically. This consolidated approach positions your bank to respond swiftly to market changes, attract new customers, and foster loyalty among existing ones.

In a landscape where rapid response and local authenticity significantly influence consumer decisions, banks that embrace a consolidated approach will have a distinct competitive advantage. It’s time for banks to streamline, unify, and scale smarter, capitalizing on every opportunity the market presents.