Why Managing Business Listings for 100+ Locations Breaks Without a Central System

Summary

Managing business listings may work manually at small scale, but once a brand reaches 100+ locations, the cracks start to show. Without a centralized system, location data becomes inconsistent, harder to update, and increasingly risky for search visibility and brand trust. This blog breaks down why listings management fails at scale—and how centralization solves it.

Managing business listings becomes unmanageable once a brand reaches roughly 100 locations. What starts as routine updates to hours, addresses, and categories quickly becomes an operational risk tied to visibility, accuracy, and brand consistency.

At enterprise scale, listing ownership spreads across regions, franchisees, agencies, and internal teams. Without a single source of truth, updates move unevenly, approvals vary, and changes propagate inconsistently across search platforms and directories. The result is conflicting location data, limited auditability, and growing exposure during acquisitions, rebrands, seasonal changes, or closures.

This article breaks down what actually fails at enterprise scale in listings management, why SMB-focused tools fall short, and what a centralized, governance-first approach must support to maintain trust and entity clarity across every location.

What managing business listings looks like at 10 vs. 100+ locations

Managing business listings across multiple locations often looks simple on a small scale. With a limited footprint, informal workflows still hold together.

At this stage, listings updates typically happen through a mix of hands-on effort and lightweight coordination:

- Regional or brand operations teams log into Google Business Profile, Facebook, and a small set of priority directories when changes are needed

- Local managers update hours, phone numbers, or holiday closures directly

- Shared spreadsheets track addresses, credentials, and recent edits

Errors happen, but they remain visible and relatively contained.

That operating model breaks once brands move past 100 locations and listings management shifts from an occasional task into a core operational function.

Update volume increases quickly. Seasonal hours overlap with staffing changes, relocations, acquisitions, and temporary closures across regions. Brand operations teams, shared services groups, agencies, and franchise partners all touch the same location data. A single incorrect update can ripple across hundreds of locations or introduce duplicate listings that persist for months.

At this scale, listing management becomes a coordination challenge. Teams struggle to establish ownership, validate accuracy, and track changes across platforms. Routine questions—what changed, who approved it, and where it propagated—become difficult to answer. Without audit trails or centralized oversight, isolated errors compound into systemic visibility gaps across search and discovery channels.

What breaks when listings management scales past 100 locations

Managing business listings at enterprise scale breaks down because governance cannot keep pace with distributed ownership. Without a centralized system, updates fragment across platforms, audit trails disappear, and inconsistent data weakens trust and entity resolution across search and AI-driven discovery.

These failures reflect broader realities of multi-location listings management as brands expand faster than their operational controls.

Governance collapses without centralized control

Listings governance rarely fails in a single moment. It degrades as ownership spreads across regions, agencies, franchisees, and internal teams.

Approval paths differ by market or disappear entirely. Local teams update listings to move faster, often without visibility into brand standards or downstream impact. Over time, corporate teams lose the ability to trace what changed, who approved it, or whether updates align with policy. Accuracy shifts from a governed process to individual behavior, making consistency difficult to maintain.

Data fragmentation becomes the default state

Listings data drifts as updates apply unevenly across platforms. Google, Apple, Facebook, Yelp, and data aggregators begin reflecting different versions of the same location. Addresses, hours, phone numbers, and categories diverge gradually, then noticeably.

When platforms receive conflicting signals, locations become less likely to surface for intent-driven queries, especially in proximity-based searches where accuracy directly influences relevance.

Spreadsheets and shared docs fail as systems of record

Spreadsheets often persist long after they stop functioning as reliable systems of record. Teams rely on them to track location data, credentials, and update status, even though they have no connection to live listings.

Without real-time sync, validation, or audit trails, these documents quickly become outdated. During rebrands, acquisitions, or seasonal changes, teams reference files that no longer reflect what customers see in search results. The gap between internal records and live listings is widening at the moment; accuracy matters most.

Updates stop propagating consistently

Execution breaks down even when teams make the right changes.

- Some directories update immediately, while others lag or revert

- Data aggregators overwrite recent edits weeks later

- Teams lack confirmation that changes persisted across every platform

Without confidence that updates are held, issues surface only after visibility drops, customer confusion increases, or reporting flags a problem. Listings management becomes reactive rather than proactive, with fixes chasing failures rather than preventing them.

Why SMB listings tools fail at enterprise scale

Listings tools built for small businesses assume a narrow ownership model. One person or a small team controls updates, makes changes directly, and moves quickly without formal oversight.

That assumption breaks once listings management becomes shared across regions, agencies, franchise partners, and internal teams.

At enterprise scale, tooling assumptions start working against the brand. This becomes especially visible in AI-driven discovery. Large language models (LLMs) tend to favor small and independently owned businesses over chains and franchises when data signals are unclear or inconsistent. When enterprise brands rely on SMB-oriented tools, they amplify fragmented signals instead of correcting them, reinforcing the disadvantage rather than closing it.

The problem isn’t speed. It’s governance.

SMB tools prioritize execution while leaving controls outside the system. Access permissions remain shallow. Approval paths are limited or missing. Brand standards live in documents and playbooks instead of inside the workflow that governs updates. As location counts rise, listings management shifts from a task into an operational system, but the tooling never makes that transition.

Teams compensate manually. Corporate groups review listings after changes occur rather than managing accuracy upstream. Audits happen in samples instead of across the full footprint. Errors surface as performance drops, customer complaints, or reporting flags, rather than through prevention.

At enterprise scale, this operating model becomes fragile. Accuracy depends on human vigilance rather than embedded controls, and the effort required to maintain consistency grows faster than the organization can realistically support.

How listings failures impact trust and entity resolution in AI-driven discovery

Listings accuracy influences more than traditional local rankings. It shapes how search engines and AI systems decide whether a location is credible, distinct, and worth surfacing at all. When listings break at scale, the impact extends beyond visibility into how a brand is understood as an entity.

Inconsistent data weakens trust signals. When hours differ across platforms, addresses vary slightly, or categories shift by location, discovery systems receive mixed inputs. At a small scale, those inconsistencies may be overlooked. Across hundreds of locations, they become patterns that reduce confidence in the data as a whole.

AI-driven systems rely on reconciliation rather than assumption. They compare information across directories, maps, data aggregators, social platforms, and owned properties to determine whether records represent the same real-world location. Duplicate listings introduce uncertainty about ownership. Mismatched names or addresses complicate entity matching. Category drift blurs how the business should appear for intent-driven queries.

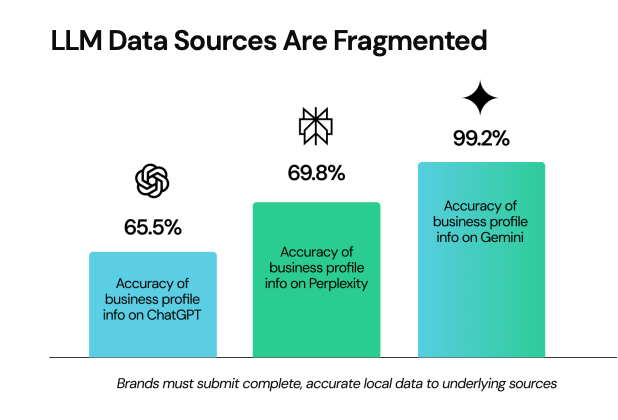

Research reinforces the sensitivity of this process to data quality. SOCi’s The Factors Driving AI Visibility report found that large language models vary widely in business data accuracy, with performance ranging from the mid-60% range to near-complete accuracy depending on the consistency of underlying sources. When listings data fragments, representation becomes unpredictable across AI systems.

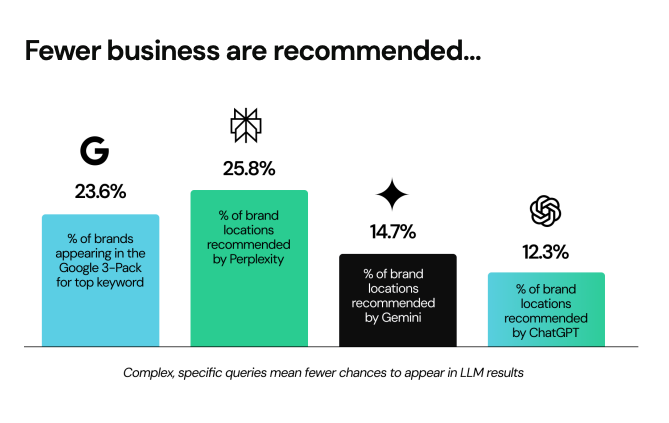

That uncertainty has direct visibility consequences. The same SOCi report shows that brand locations are recommended only 17.6% of the time in AI-generated results, compared to 23.6% visibility in Google’s traditional local 3-Pack.

In environments where AI returns a single answer instead of a ranked list, inconsistent listings data reduces the likelihood of being selected at all. There is no secondary result to recover visibility once trust signals break down.

At enterprise scale, listings accuracy functions as infrastructure. It supports local visibility, influences whether locations are referenced in AI-generated responses, and reinforces brand credibility at the entity level. When that foundation degrades, discovery performance reflects it quickly and unevenly.

What an enterprise-grade listings management approach requires

Once listings management becomes a shared responsibility across hundreds of locations, success depends on structure rather than effort. Enterprise teams need systems designed to manage change at scale, maintain consistency under pressure, and reduce reliance on manual intervention.

Platforms built specifically for enterprise-scale, such as SOCi, treat listings management as governed infrastructure rather than a collection of individual profiles.

A centralized source of truth

Accuracy starts with clarity. Enterprise listings management requires a single, authoritative intelligence layer that defines what is correct for every location.

Brand standards cannot live solely in documents or training. They need to operate directly within the system that governs listings updates. When location data is managed centrally, teams reduce variation, eliminate conflicting records, and avoid the informal handoffs that introduce drift—often weeks later during aggregator refresh cycles.

Scalable governance and permissions

As participation expands, ownership must remain explicit. Enterprise workflows depend on clear roles that separate who can propose changes from who can approve them.

Corporate, regional, and local teams require different levels of access without slowing execution. Governance should guide updates forward while discouraging workarounds that emerge when approval processes feel disconnected from daily operations.

Continuous accuracy across every directory

Listings accuracy degrades quietly. Directories refresh on different schedules. Data aggregators overwrite fields long after updates are made. Platforms revert changes without warning.

Enterprise teams managing business listings across multiple locations cannot rely on periodic cleanups. Accuracy requires ongoing monitoring that detects drift as it happens and corrects it before visibility or customer trust takes a hit. Coverage must extend beyond a short list of directories to prevent gaps from forming across the broader listings ecosystem.

Auditability and accountability

Once listings become enterprise infrastructure, change history becomes operationally critical.

Brand operations leaders, shared services teams, and compliance stakeholders need visibility into what changed, when it happened, and how it aligned with policy. During acquisitions, legal reviews, franchise disputes, or closures, teams rely on auditability to confirm that updates followed approved workflows and applied consistently across hundreds or thousands of locations.

How an agentic workforce model changes listings management at scale

Traditional listings workflows assume teams will manage change manually. That model breaks once brands manage business listings across multiple locations at enterprise scale.

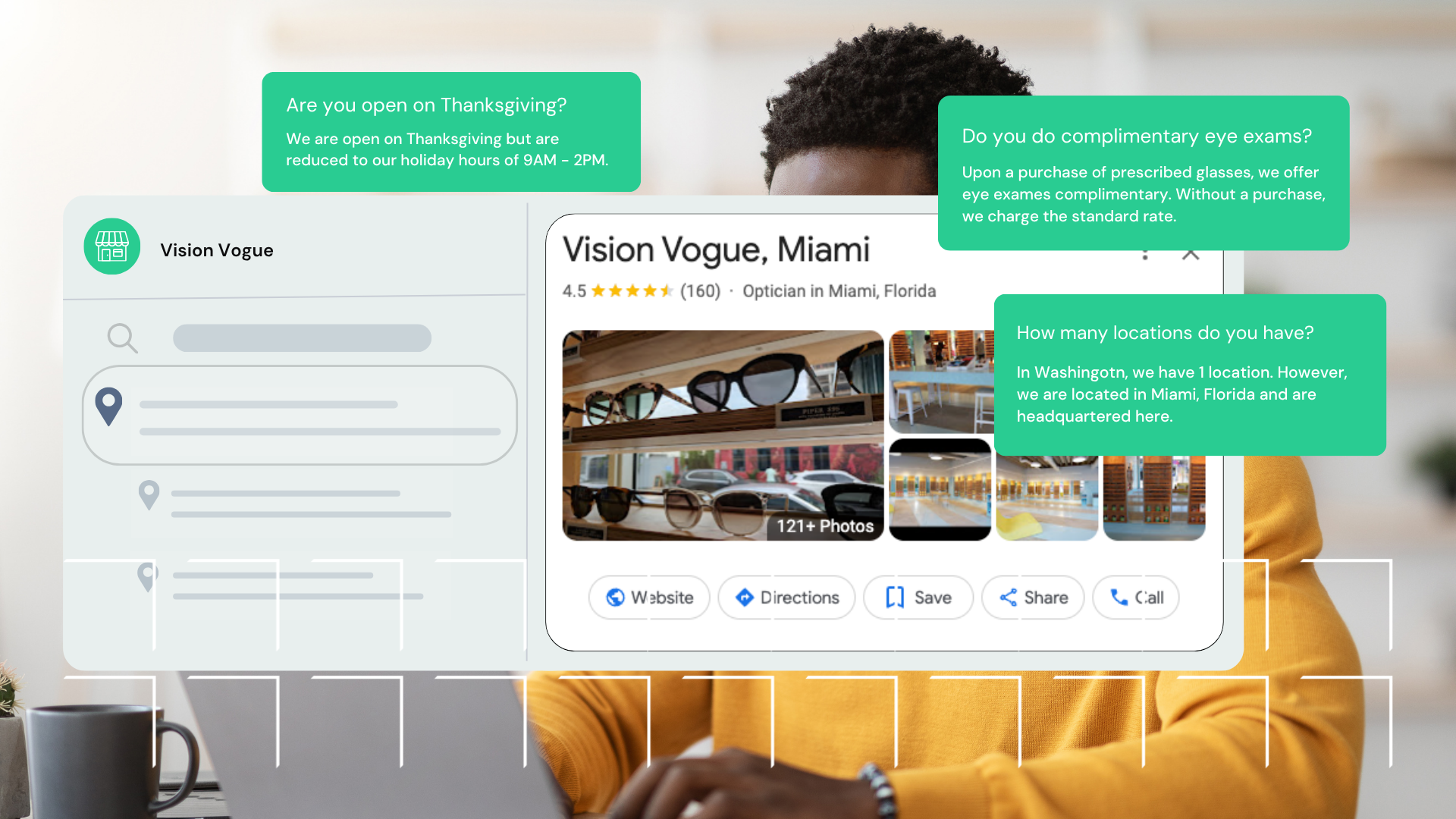

An agentic workforce approach treats listings maintenance as continuous operational work rather than a periodic task. With SOCi, each location operates under a brand-trained AI agent that applies centralized governance rules and maintains accuracy across directories without requiring corporate teams to intervene location by location.

The shift is operational, not conceptual.

Instead of shared services teams logging into platforms or reconciling spreadsheets, maintenance runs continuously in the background. Agents monitor for data drift, reconcile discrepancies introduced by aggregators, and correct issues before they surface in reporting or customer experience. Standards hold across regions and ownership models, while visibility remains stable across search and AI-driven discovery environments.

Common enterprise scenarios where centralized listings matter most

Centralized listings management becomes critical during moments of change. These are the situations where distributed ownership and manual workflows fail fastest, often with immediate impact on visibility, customer trust, and downstream performance.

Mergers and acquisitions

New locations enter the ecosystem with inconsistent data, duplicate listings, and inherited errors. Without centralized control, teams struggle to reconcile naming conventions, addresses, and categories across platforms, leaving discovery systems to interpret conflicting signals during periods of heightened scrutiny.

Brand refreshes or renaming initiatives

Name changes, updated descriptions, and category shifts need to appear consistently across every directory. When updates roll out unevenly, outdated brand identities persist in search results, creating confusion and weakening entity clarity long after the transition ends.

Seasonal hours and temporary closures

Retail, food, healthcare, and service brands frequently adjust their hours. When changes propagate unevenly, customers encounter closed locations marked as open or outdated hours displayed across maps and listings, triggering avoidable complaints and trust erosion.

Rapid expansion or market exits

New locations introduce both volume and complexity. Closures introduce risk when listings are not updated or suppressed correctly. Without centralized oversight, outdated locations linger in discovery environments, pulling attention away from active markets and distorting performance reporting.

Crisis situations requiring immediate updates

Weather events, safety issues, or operational disruptions demand fast, coordinated action. During disruptions, inaccurate listings often surface alongside negative customer feedback, amplifying frustration and creating reputational impact that persists after operations return to normal.

Key takeaways for enterprise marketing and operations leaders

Managing business listings across multiple locations becomes increasingly complex as brands grow. Success at enterprise scale depends on systems that support control, visibility, and accountability across hundreds or thousands of locations.

Several realities define that shift:

- Listings accuracy relies on centralized intelligence rather than isolated updates

- Execution must operate continuously as platforms refresh and data shifts

- Trust and entity clarity weaken when location data varies across directories

- Multi-location brands require systems designed for enterprise operating models, including shared services, brand operations teams, and franchise structures

For marketing and operations leaders, listings management functions as infrastructure. Control, visibility, and accountability need to live inside the workflow itself. Without that foundation, inconsistencies compound, visibility declines, and discovery performance reflects the gaps. Enterprise brands increasingly turn to platforms like SOCi and purpose-built business listings management software to manage listings as governed infrastructure rather than an ongoing clean-up effort.